Thursday, September 30, 2021

Dear Your Overseas Dream Home Reader,

Dear Your Overseas Dream Home Reader,

On my second to last visit to Florence I took a number of tours…

A foodie tour, a photography class/tour and my usual every free walking tour available. As we battled the crowds I asked our guide when high season runs until…he

paused…”Christmas…well Christmas is still busy…the second and third weeks of January, and then things pick up again.” I picked my jaw up off the floor and continued. He was talking about a tourism juggernaut that just doesn’t sleep.

If you are sensing a recurring theme that I mix business and pleasure in Italy you are right. Thing is—I chose Florence as a break…an escape from work…expecting there would be no real estate opportunities. But I couldn’t help myself. I walked 10 minutes in all directions from the old town and tuned in to the Idealsita app on my phone.

What I saw shocked me…I did the math…did it again…and it still added up to potential 18% gross yields buying a little apartment and renting it out on Airbnb. I won’t say my vacation was ruined…more it changed course.

This became one of my most exciting discoveries of the past few years. Then Covid hit…

Now, as things open up again, I have sent my scouts back to investigate as part of my Mission Italy project.

Two of my best men are on the ground in Italy, literally wearing the soles from their shoes as they scout, so that we can find the best deals.

After all, as General Patton once said, “A pint of sweat will save a gallon of blood.”

My scout Eoin has been sweating his way through Florence…

Wishing you good real estate investing,

|

|

Ronan McMahon, Real Estate Trend Alert

Gangster Bankers and Gelato

By Eoin Bassett

They were the godfathers of banking. Lords of plunder and pomp. They invented double-entry book keeping…letters of credit…bills of exchange…

They introduced the world to the idea of a holding company.

If that stuff bores you, they also murdered their opponents, slept with royalty and—500 years or so after their heyday—got their own Netflix show.

The Medici’s are pretty famous.

From their home city of Florence they bankrolled popes, kings and mercenary warlords.

Leonardo da Vinci worked for them, along with some of the greatest artists who have ever lived. The family’s central role as patrons of the Renaissance is the reason Florence attracts 16 million tourists a year when there’s no pandemic.

And you and I can cash in on the Medici’s legacy using one of their banking tricks…

|

|

We can borrow from an Italian bank at incredibly low rates and use that money to own an income-earning property in what is one of the world’s most beautiful and cultured cities.

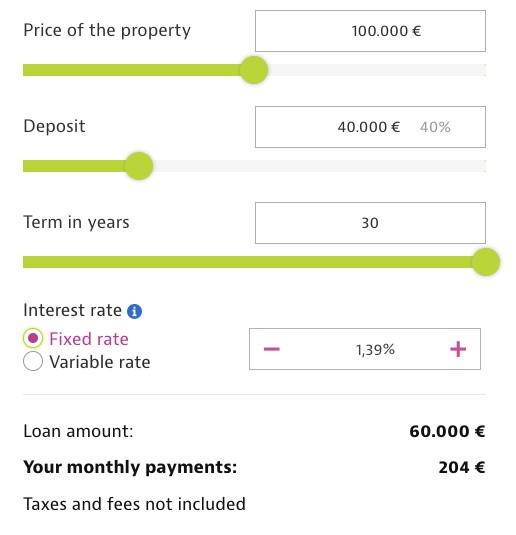

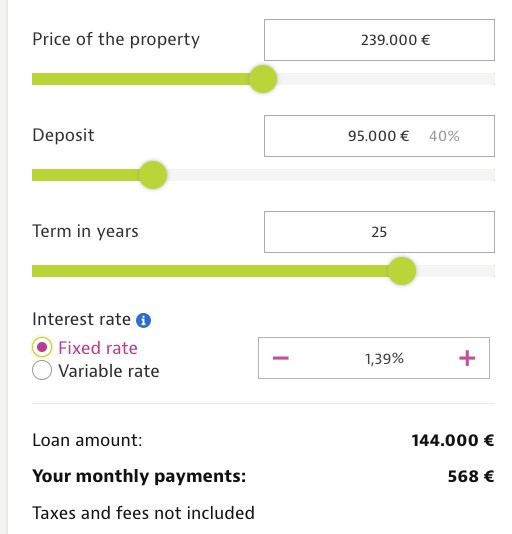

Italian banks will lend 60% of the value of a property to an American. I saw fixed rates of 1.39%. I suspect that with the right mortgage advisor in Italy you might do better again.

Here are some practical examples:

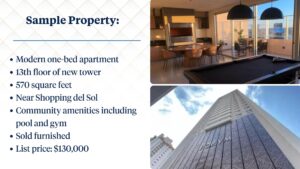

If you are on a budget and just want a little base: The Piazza della Signoria is the beating heart of the historic core of Florence. Three minutes’ walk away I found an 80-square-meter pied à terre. In square feet, it’s 861.

It’s semi-basement, meaning there are small windows peeking out at the street at ceiling level. It’s in a 14th-century building and listing for €100,000 ($117,338).

A quick calculation on the mortgage thingamajig says €40,000 down and monthly payments of €204.

|

|

If you are on a really tight budget you can find semi-basement apartments for even less. They might be okay if all you want is a little bolthole in Florence. A place to put your head down.

If you’re willing to spend more per square meter then you can find properties like this one:

Just 65 yards from the city’s famous bridge the Ponte Vecchio and minutes’ walk from all the big attractions is a nice one-bedroom with a terrace. It’s been a short- and medium-term rental for a long time and needs a makeover. At €190,000 it’s 50 square meters (That’s $222,715 and 538 square feet.)

But that’s not a real bargain. To find true value you have to hit the streets…

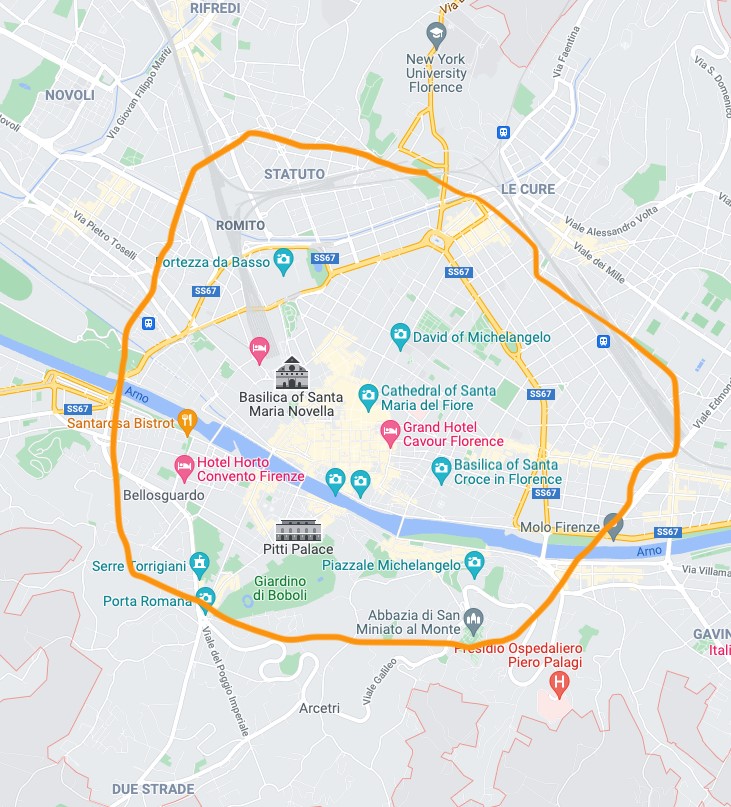

My trendy new fitness watch tells me I walked 32 miles in two days around Florence. I mean literally around…

I drew a big circle around the historic core on a map. I wanted to explore all the neighborhoods a 20-minute walk or less from the center. I used a printed map and Google maps. It looked a bit like this…

|

|

Overlooked and unloved. That’s what Ronan calls the sort of properties I was after on my grand ramble. The listing photos are usually bad. The place is poorly furnished, badly decorated…

But all we need is imagination and a decorator.

I was looking specifically for larger, two and three-bed properties. Close to a park, stores, restaurants and cafés…and walking distance of no more than 20 minutes to the city center.

I liked the value play in the Porta al Prato district. Between the river Arno and the train station the vibe was pleasant. Kids playing in a park, people stopping for coffee and cake in an stylish café…some nice-looking trattorias…

An example: I found a two-bed for €239,000. It’s 80 square meters and was apparently renovated in 2015. (That’s $218,016 for 861 square feet.)

Use Italian bank financing to get that 60% and you’re looking at monthly payments of $666.

|

|

Now the income angle…

Two-bed rentals in the Porta del Prato area go for €95 a night at the moment—that’s $111.

Let’ repeat…Florence get 16 million visitors a year. All of them want to see the historic center, the art…they want to shop, and dine…

I asked Ronan what he thought and he says:

“Tourism hasn’t returned in earnest yet. Those rental rates I expect will jump by 50% or more as travel returns and the demand-supply balance flips back in favor of landlords. It sounds like our window of opportunity is still very much open but maybe even stronger because now we can fix a long-term interest rate that’s significantly negative in real terms (allowing for inflation). It’s almost like you get paid twice…once by the renters and secondly by negative real interest rates. Meantime the long term prospects of owning “old stones” in the one and only Florence is strong.”

|

|

I’ve scouted a lot of real estate…

Farms at the foot of a volcano on a lake island in Nicaragua…beachfront villas on a cannibal island in the South Pacific…condos in Colombia…hill-town homes in Portugal…

Italy’s up there as one of the most complicated places I’ve done this…

Dozens of small agencies, lots of private sellers, different types of auctions, no MLS…and some truly exotic legal and bureaucratic oddities to figure out.

But it’s worth it…

Imagine owning an apartment in Florence…

On his deathbed the founding father of the Medici bank told his kids to keep out of the public eye.

Keep your head down. Focus on the business.

Kids never listen…

In the case of the Medici’s the kids hired every artist they could to decorate their city.

Statues, paintings, incredible architecture…

But I’ll tell you a secret. I’m not sure I really like Renaissance art. I get its significance. It just doesn’t move me….lots of satyrs and naked angels.

I do however have a passion for great coffee, delicious food, wine, cheese, gelato and strolling around one of the most walkable and stylish cities the world has to offer…

|

*Advertisement* Where in the World is Right For You? Eoin Bassett is no stranger to scouting the world’s best locations for real estate…he’s a former Editorial Director of International Living and during his time there he scouted half the known world…and 8 of the top 10 destinations on International’s Living’s Global Retirement Index. Now in its 30th year, the Index is a comprehensive resource detailing the very best countries around the world to live, invest, and retire. Even if you’re not yet thinking of retirement but are interested in living or buying a property overseas…there is lots of valuable intel for you in there. Click here for some more info about exactly what the Index is all about. |

Like what you’re reading?

Send your thoughts to feedback@realestatetrendalert.com. I’ll post and respond to as many of your emails as I can right here in the e-letter. Find out more about our feedback policy here.

|

Connect with us on Instagram

|